Three steps to a nicer ISA

Here’s three steps you can take today to get the most from your Cash ISA.

Money Matters | April 2025

ISAs are a go-to choice for millions of UK savers looking to grow their hard-earned cash and investments, free from tax.

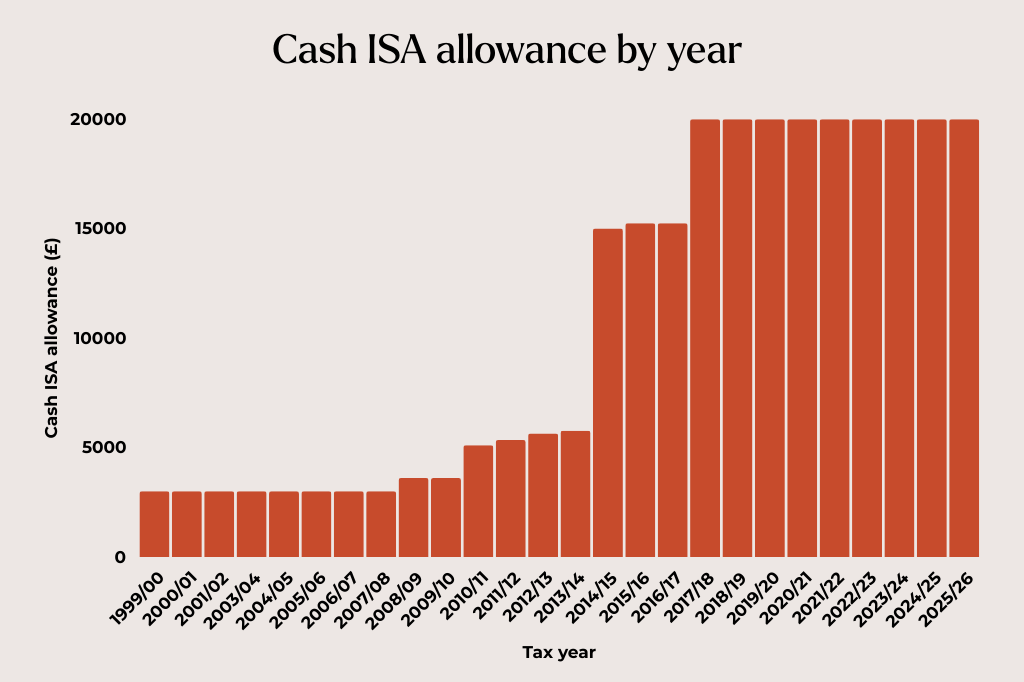

Cash ISAs, launched in 1999, can proudly declare themselves as unshakeable, weathering tenures of seven prime ministers, enduring three global recessions, and now, navigating the uncertainty of Donald Trump’s yo-yo tariffs.

But, with Government threats to reduce the tax-free savings allowance, is the Cash ISA bubble about to burst?

Only time will tell, but here’s three steps you can take today to make the most out of them while you still can.

First, how do they work?

The appeal is simple: Cash ISAs offer UK tax-free status and usually the ability to withdraw whenever you need to. Ever evolving, the ISA allowance currently sits at £20,000.

The £20,000 ISA allowance remains one of the smartest ways to save tax-free, in both the short and long term, so it should always be part of a balanced financial plan.

1. Use it or lose it

Any unused allowance in a tax year cannot be rolled over into the next tax year, so it’s important to use it while you have it.

Despite its popularity, the future for Cash ISAs had a scare last month when Chancellor Rachel Reeves considered lowering the ISA allowance from £20,000 to £4,000 in her Spring Statement. In a relief for savers, this didn’t happen, but warnings point to a potential change to the Cash ISA allowance in the budget next Autumn.

So, don’t wait around. The best time to max out your 2025/26 £20,000 ISA allowance is now, taking advantage of the beginning of the tax year. The tax-free benefit might not be with us forever, but at least you’ll make the most of what you had today.

2. Transfer-in older ISAs from other banks

You can save up to £1m in some Cash ISAs, but you can only contribute up to £20,000 to them per tax year. This is how some (very patient) savers have become ‘ISA millionaires’.

That gives you loads of room to transfer-in your ISA balances from years’ past that might not be currently working very hard for you, as well as consolidate a lot of life admin.

Saving deposits of up to £120,000 currently are protected by The Financial Services Compensation Scheme (FSCS). For the most up to date information on the FSCS limit, click here.

3. Turn ISA into ISAs

You can open different ISA accounts and types of ISA as long as your total subscriptions aren’t more than £20,000 per tax year.

This helps you to get the best mix of account types and rates for you. However, if like many, you’re happy with your provider and your rate, you might prefer to consolidate and save yourself some life admin.

The future for ISAs

At HTB, we have no crystal ball. The Cash ISA may be popular, but that doesn’t mean that allowances will stay the same. If we’ve learnt anything from the Government’s discussion to lower the allowance, it’s that it may have a shelf life.

When will this change? We don’t know, but you have a new tax year and a new £20,000 allowance for at least another year… don’t let it go to waste.

Learn more about our range of Cash ISAs here.

By ‘tax free’ we mean the interest you earn in an ISA isn’t subject to UK Income Tax and Capital Gains Tax. Tax treatment depends on your individual circumstances and could change in future.

We offer solutions for businesses, individuals and intermediaries.